Last updated in August 2024

The purpose of this guide is to provide an overview of the taxation and key aspects of various types of equity-based compensation plans and cash-based awards in Estonia. The first part provides a detailed overview of the taxation and considerations for different types of equity compensation plans in Estonia. The second part summarises these plans in a chart, detailing the key aspects of Employee Share Option Plans (ESOPs), Restricted Share Units (RSUs), Performance Stock Units (PSUs), Employee Share Purchase Plans (ESPPs), Stock Appreciation Rights (SARs), Phantom Stock and other cash-based plans.

Part I

General Taxation

Basis of taxation

In Estonia, various types of equity awards are taxed as fringe benefits, with the exception of cash awards such as SARs, phantom stock and various other cash plans. These cash-based awards are taxed as salary and are subject to all payroll taxes. In Estonia, fringe benefits are taxed only at the level of the employer company. This applies even if the benefit is provided by another group company, such as a foreign parent company.

There are no employee-related taxes if the share award is treated as a fringe benefit. Fringe benefits are not personalised in Estonia. The employee could be subject to tax if he or she subsequently sells the shares acquired.

Unlike in most other jurisdictions where fringe benefits are taxed similarly to salaries (i.e. there are employee taxes to be withheld and employer taxes to be paid by the employer on the value of the benefit), in Estonia fringe benefits are taxed with corporate income tax at a rate of 20/80 (i.e. 25% of the net amount) and social tax at a rate of 33%. In addition, the corporate income tax amount is subject to social tax, resulting in a combined tax rate of 66.25% on the net benefit received by the employee.

From 2025, the corporate income tax part of the fringe benefit taxation will increase from 20/80 to 22/78, resulting in a combined tax rate of approximately 70.5%.

For example, if the benefit provided to an employee (e.g. the value of the shares underlying the RSUs at settlement) is EUR 1,000, the combined tax amount is EUR 662.50. The corporate tax element is calculated as follows 1,000 / 0.8 * 20% = 250. The social tax is calculated as follows (1,000 + 250) * 33% = 412.50.

Taxable event

Generally, the taxable event occurs when the employee receives the shares underlying the equity award. For example, for RSUs, this is at vesting/settlement. For share options, the taxable event is the date of exercise. For an employee share purchase plan, the taxable event is on the purchase date when the discount is granted and the shares are acquired.

For the sake of clarity, the grant of options, RSUs etc. does not trigger taxation.

Taxable value

The taxable value is the benefit received by the employee and depends on the type of equity award.

For example, in the case of RSUs, the taxable value is the market value of the shares at the time of settlement. For share options, the taxable value is the market value of the shares at the time of exercise less the exercise price (i.e. the spread). In the case of an ESPP, the taxable value is the discount granted.

For example, if the market value of the shares underlying the stock options is EUR 1,500 and the exercise price payable by the employee is EUR 600, the benefit, i.e. the taxable value, is EUR 900 (the spread). This means that, unless a tax exemption can be applied (see below), the EUR 900 is subject to fringe benefit taxation.

Compensation of taxes by the employee

If the employee is required by a relevant agreement or plan to compensate the employer or the issuing company for the tax cost (whether in cash or by a reduction in shares), this amount reduces the taxable value of the fringe benefit to the employer.

The following examples can be used to illustrate the above.

First, if the taxable value is EUR 1,000 and the employee is required to compensate the combined tax amount of EUR 662.50, the taxable value for the employer is reduced by EUR 662.50 because the amount compensated reduces the taxable value (i.e. the benefit provided to the employee). As a result, the actual taxable value is EUR 337.50 (1,000 – 662.50) and the actual combined tax amount for the employer is approximately EUR 223.59 (337.50 * 66.25%), which is less than the amount actually paid by the employee.

A more appropriate method to calculate the amount of tax cost which need to be compensated by an employee is to consider the EUR 1,000 inclusive of the tax cost. Namely, the tax cost which need to be compensated by the employee is calculated using the following method: 1,000 – (1,000 / (1 + 66.25%)) which approximately results in EUR 398.50. This means that the taxable value for the employer is EUR 601.50 (1,000 – 398.50), and if we calculate the combined tax amount from EUR 601.50, we get 398.50 (i.e., 601.50 * 66.25%). This means that the actual tax cost compensated by the employee is equal to the actual tax paid by the employer.

If the tax cost is compensated by a reduction in shares, the above is also relevant and means that the value of the shares to be reduced should equal to EUR 398.50, considering the same example above.

Tax declaration

The employer must declare fringe benefits on the TSD tax return, Appendix 4. The TSD form with the completed annexes must be submitted to the Estonian Tax and Customs Board and the tax must be paid by the 10th day of the month following the month in which the taxable event occurred.

If the conditions for tax exemption described below are met, the employer is not required to declare or pay tax.

Tax exemption (tax incentive)

As an exception to the general rule described above, tax exemption applies if

- there is a period of at least 3 years between the grant date and the settlement / exercise of the equity award; and

- the underlying asset of the equity award is an interest in the employer or in a company belonging to the employer’s group.

If these conditions are met, the exercise of stock options, the settlement of RSUs or the discount in the case of an ESPP is tax-free for the employer. In addition, if 100% of the shares of the issuer company are sold, or if an employee is declared disabled, or in the event of an employee’s death, taxes are not applied on a pro rata basis based on the period of time the equity award was held prior to the exercise of stock options or the settlement of RSUs. The proportion is calculated based on the actual time between the grant date and the relevant event.

Employees who are eligible for the tax incentive

The taxation rules described above apply only if the participant qualifies as an employee under Estonian tax law. The term “employee” includes:

- Employees

- Board members

- Self-employed persons

- Natural persons who work or provide services based on a contract for services, an authorization agreement, or any other contract under the law of obligations

The Estonian Tax and Customs Board has also confirmed that individuals working under employer of record arrangements may be considered employees for the purposes of fringe benefit taxation, including eligibility for tax exemptions.

The above means that these special rules do not apply if an individual provides services through his or her personal company, or if the professional relationship is with the personal company but the share awards are made directly to the individual.

Reporting

If the option agreement is not digitally signed (in accordance with EU electronic signature standards) or notarised, the employer must submit the agreement to the Estonian Tax and Customs Board within 5 working days of signing the agreement. However, in practice, the Estonian Tax and Customs Board has confirmed that alternatives that allow the date of signing of such an agreement to be determined retrospectively are also accepted. These include share award management software such as Carta, Fidelity, E*Trade, Ledgy and the DocuSign e-signing platform. In this case, there is no need to send the agreements to the Estonian Tax and Customs Board.

TAXATION AT EMPLOYEE LEVEL

Sale of shares

An employee will be taxed on any gain realised at a flat personal income tax rate of 20% (22% from 2025). The taxable amount is the difference between the sale proceeds and the acquisition cost, i.e. the price paid for the shares, if any (less any expenses incurred in connection with the sale of the shares, e.g. brokerage fees).

The value of the shares taxed as a fringe benefit upon settlement of the RSUs or exercise of the options is also considered part of the cost. For example, if the benefit received and taxed is EUR 1,000 (e.g. the fair value of the shares on settlement of the RSUs) and the employee sells the shares for a total value of EUR 1,200, only the gain of EUR 200 is subject to income tax. If the employee is required to compensate the any tax expense to the employer in cash, this amount is also considered part of the acquisition cost.

The employee must declare the gain realised on the sale of the shares. The employee must submit the annual income tax return to the Estonian Tax and Customs Board by 30 April of the following calendar year. The tax is payable by 1 October of the following calendar year.

A different treatment may apply if the employee uses a special investment account regime available to Estonian residents holding certain financial assets (mainly listed financial assets such as securities). The investment account regime allows the employee to defer the payment of personal income tax.

Receipt of dividends

Dividends received from abroad are not subject to taxation in Estonia if income tax has already been withheld from the dividends abroad, or if the profit on which the dividends are based has been taxed abroad and the tax paid can be verified. However, even if the foreign dividends are not subject to Estonian tax, the employee must declare these dividends in his or her annual personal income tax return.

If income tax has not been withheld or if the profit on which the dividends are based has not been taxed abroad, the employee must pay 20% (22% from 2025) income tax on such dividends. The employee must submit his or her annual income tax return to the Estonian Tax and Customs Board by 30 April of the following calendar year. The tax is payable by 1 October of the following calendar year.

Domestic dividends are not subject to additional taxation for the employee. However, a resident company distributing dividends may be required to withhold 7% income tax if the dividends are deemed to be regularly distributed dividends and are subject to a lower corporate income tax rate as defined by the applicable tax law. However, the lower corporate tax rate and the regularly distributed dividends rules will be abolished from 2025.

OTHER KEY ASPECTS

Cashless exercise of options

Estonian tax practice allows for the cashless exercise of options, i.e. no actual shares are issued to the option holders, who receive the difference between the sale price and the exercise price (and any compensated taxes). From a tax perspective, there would still be two taxable events: (i) the exercise of the option (including the application of any exemptions) and (ii) the sale of the shares.

Alternative equity-based compensation plans

In practice, there are various types of equity compensation plans, depending on the jurisdiction in which the issuing company is domiciled. For example, it is common for employees participating in a plan similar to an Employee Share Purchase Plan (ESPP) to receive additional free shares if they hold the shares for a certain period of time. The Estonian Tax and Customs Board has confirmed that similar plans may also be subject to special tax rules in Estonia, provided that the benefits (i.e. free shares) are not transferred before the third anniversary of the start date of the plan.

In addition, the Estonian Tax and Customs Board has confirmed that if the shares to be issued to employees are held through a custodian bank, fund or association, the relevant rules may still apply but should be analysed on a case-by-case basis (e.g. a French FCPE).

Taxation of cash-based compensation plans

As described above, cash-based compensation plans (e.g., SARs, phantom stock) are taxed as salaries and are subject to all payroll taxes. According to the practice of the Estonian Tax and Customs Board, even if the cash is paid out by a foreign parent company, the actual employer (e.g., a local subsidiary) must process it through local payroll. This means that the applicable taxes must be declared and paid, as the cash remuneration is essentially linked to the employment relationship with the employer.

The applicable taxes are the following.

Employee-related taxes which are withheld from the gross amount:

- Unemployment insurance contribution at the rate of 1.6% (employee’s part).

- Funded pension at the rate of 2%, if applicable (from 2025, employees may choose to pay 4% or 6% instead of 2%).

- Personal income tax at the rate of 20% (22% from 2025).

Personal income tax is withheld from the amount which equals to the taxable amount (i.e., gross amount) less the unemployment insurance payment and the funded pension. For example, if the taxable amount is 1,000, the unemployment insurance contribution is 16, the funded pension 20 and the personal income tax 192.80 – i.e., (1,000-16-20)*20%.

The basic personal allowance (generally used only for monthly salaries) is EUR 7,848 per year which is EUR 654 per month (applicable up to an annual income of EUR 14,400). If the annual income is between EUR 14,400 to EUR 25,200, the basic tax exemption is calculated using a specific formula: 7,848 – 7,848 ÷ 10,800 × (income amount – 14 400). If the annual income exceeds EUR 25,200, the basic tax exemption is zero. From 2025, the basic tax exemption in Estonia will be EUR 8 400 per year (EUR 700 per month), regardless of the annual income of the individual. This means that the calculation previously required will no longer be necessary. However, it is currently being considered to postpone this change until 2026.

Employer-related taxes paid pay the employer on top of the gross amount:

- Unemployment insurance contribution at the rate of 0.8% (employer’s part).

- Social tax at the rate of 33%.

The employer must declare the cash payments on the TSD tax return, Appendix 1. The TSD form with the completed annexes must be submitted to the Estonian Tax and Customs Board and the tax must be paid by the 10th day of the month following the month in which the taxable event occurred (i.e. when the payment was made).

In light of the above, companies should try to take advantage of the tax incentives available for share-based compensation plans, as the tax treatment is much more favourable to the employer.

Deductibility of equity award costs

Equity award costs are deductible for the employer.

Employment law considerations

Estonian labour law does not specifically deal with equity awards and no relevant case law has been developed. Therefore, it is somewhat questionable whether similar equity awards (employee incentive plans) could be considered as part of the employment contract or as a separate legal relationship between the parties. If they are deemed to be part of the employment contract, employees could bring the relevant disputes before the Estonian courts and the Labour Dispute Committee, regardless of the jurisdiction clause contained in the relevant agreement or plan.

Security law considerations

In Estonia, the offer of securities is generally subject to the rules set out in the EU Prospectus Regulation (Regulation (EU) 2017/1129). The European Securities and Markets Authority (ESMA) has stated that options and similar non-transferable share-based awards fall outside the scope of the Prospectus Regulation. ESMA has further clarified that the exercise of such options also falls outside the scope of the Regulation, as it does not constitute a separate offer at the time of exercise.

Therefore, if the awards offered to employees are non-transferable, they are not subject to the Prospectus Regulation and there is no obligation to publish a prospectus or other information document. However, ESMA has warned that where transactions are structured as options or similar schemes but effectively constitute an offer of securities, competent authorities such as the Estonian Financial Supervision and Resolution Authority (EFSA) may requalify these options as an offer of securities in order to prevent circumvention of the Prospectus Regulation.

If the equity awards are deemed to be transferable securities, certain exemptions under the Prospectus Regulation may still apply. For example, the Regulation does not apply to offers of securities with a total consideration in the EU of less than EUR 1,000,000 (calculated over a 12-month period). This means that if securities such as RSUs are offered free of charge, there is no requirement to produce a prospectus or other information document. However, ESMA has emphasised that competent authorities may assess whether an offer presented as free of charge actually disguises a ‘hidden’ consideration. If there is no such hidden consideration, the offer should be considered to be for nil consideration and excluded from the scope of the Regulation.

If the free offer exemption does not apply, another exemption may be available for offers of securities to employees. In this case, there would be an obligation to publish an information document containing details on the number and type of securities and the reasons for and details of the offer or allotment. In Estonia, this document is not subject to coordination with the EFSA and there are no specific requirements regarding its format or content.

PART II

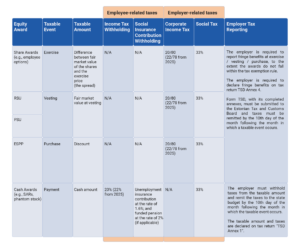

See above “basis for taxation” and “taxation of cash-based compensation plans” for exact tax calculations.

About the author

Tõnu Kolts is a managing associate and co-head of the tax practice at COBALT Law Firm in Estonia. He is a recognised expert in tax law with extensive experience in advising both domestic and international clients.

In addition to his tax expertise, Tõnu brings extensive knowledge and experience in equity and cash-based compensation plans. He provides clients with tailored solutions that address the diverse needs of companies navigating the complex landscape of employee incentives. Whether you are looking to establish an ESOP or implement global compensation strategies, Tõnu is committed to delivering results that align with your unique business objectives.

Tõnu’s comprehensive understanding of equity compensation plans has led to several successful initiatives, many of which have been incorporated into the Estonian Tax and Customs Board guidelines. Notable contributions include innovations such as cashless exercise of options on exit events, roll-over options in the event of the sale of an issuer, and adjustments to the underlying assets upon bonus issuance.

Prior to joining COBALT, Tõnu was a tax advisor at one of the Big Four audit firms in Estonia. He has been a member of the Estonian Bar Association since 2015, and actively participates in the tax law committee of the Estonian Bar Association since 2020.

If you have any questions, please do not hesitate to contact Tõnu using the contact details below.

Tel: +372 53407773

Email: tonu.kolts@cobalt.legal